Understanding Goods and Services Tax (GST): One Nation, One Tax, One Market

India's tax structure has undergone a radical transformation with the introduction of the Goods and Services Tax (GST). Envisioned as a unified indirect tax, GST aims to integrate various state and central taxes into a single tax regime, creating a streamlined process for businesses and consumers alike. This article delves into the workings of GST, its benefits, and its broader implications for the Indian economy.

What is GST?

GST is an indirect tax that replaces multiple taxes levied by both the central and state governments. It is a comprehensive, destination-based tax applied to the supply of goods and services. The essence of GST lies in its ability to unify the tax structure across India, thereby establishing a single market.

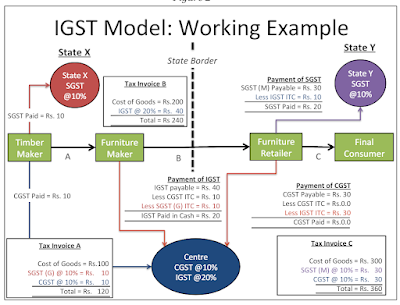

The GST mechanism ensures that tax is levied at each stage of the supply chain, from manufacturing to the final sale to the consumer. However, unlike traditional taxes, GST allows for the credit of input taxes paid at each stage, which can be utilized in subsequent stages of value addition. This system ensures that the tax is effectively levied only on the value added at each stage, preventing the cascading effect of taxes, where tax is levied on tax. PDF LINK

How Does GST Work?

Under the GST regime, businesses are required to register, file returns, and make tax payments online. The process is supported by a robust IT infrastructure, making compliance more straightforward and transparent. Here's a simplified overview of how GST operates:

- Registration: Businesses with an annual turnover exceeding the threshold limit must register for GST. Registration is a one-time process that can be done online.

- Invoicing: GST-compliant invoices must be issued for all transactions. These invoices should include details such as the GST Identification Number (GSTIN) of the supplier, the rate of GST applicable, and the amount of tax charged.

- Filing Returns: Registered businesses must file monthly, quarterly, and annual GST returns. These returns provide details of sales, purchases, input tax credits, and tax payable.

- Payment of Tax: GST payments can be made online through the GST portal. The tax paid on purchases (input tax) can be set off against the tax collected on sales (output tax), and the net tax liability is paid to the government.

Benefits of GST

The introduction of GST has brought several benefits to businesses, consumers, and the economy:

- Simplified Tax Structure: GST replaces a multitude of indirect taxes with a single tax, reducing the complexity of tax compliance.

- Elimination of the Cascading impact: By guaranteeing that taxes are only imposed on the value contributed at each level, the input tax credit system avoids the tax-on-tax impact.

- Increased Transparency: The comprehensive IT system for GST registration, return filing, and payment promotes transparency and reduces the scope for tax evasion.

- Ease of Doing Business: Uniform tax rates and procedures across the country simplify business operations, making it easier for businesses to expand and operate in different states.

- Competitive Pricing: The reduction in the overall tax burden on goods and services lowers the cost of production, leading to competitive pricing and benefiting consumers.

- Boost to Exports: By subsuming major central and state taxes and providing a complete set-off of input goods and services, GST reduces the cost of locally manufactured goods, enhancing their competitiveness in the international market.

Impact on Various Sectors

The effects of GST varied for various economic sectors:

- Manufacturing: GST has reduced the cost of production by allowing seamless input tax credits. This has led to lower prices for end consumers and improved competitiveness for manufacturers.

- Services: The service sector benefits from the uniform tax rate across states, simplifying interstate service transactions and compliance.

- Retail: The retail sector has seen a reduction in the burden of multiple taxes and compliance requirements, streamlining operations and reducing costs.

- Real Estate: The inclusion of real estate in the GST framework has brought transparency and accountability, benefiting buyers and developers alike.

- E-commerce: GST has created a level playing field for e-commerce players by eliminating the differential treatment of online and offline sales.

Challenges and the Way Forward

Despite its many benefits, the implementation of GST has not been without challenges. Initial teething issues such as technical glitches in the GST portal, frequent changes in tax rates, and compliance complexities posed difficulties for businesses. However, the government has been proactive in addressing these issues through continuous improvements and stakeholder consultations.

The success of GST depends on the continuous evolution of the tax framework to address emerging challenges and the active participation of businesses in compliance. As the GST regime matures, it is expected to bring about greater economic integration, higher tax revenues, and a more robust economic growth trajectory for India.

Conclusion

The Goods and Services Tax is a landmark reform in India's taxation landscape. By unifying the tax structure and promoting transparency, GST has created a more efficient and business-friendly environment. As the system evolves and businesses adapt, the long-term benefits of GST in terms of economic growth, competitiveness, and ease of doing business are likely to become more pronounced.

For more information on GST and its updates, you can visit the official GST portal.

)_20240526_194452_0000.png)

0 Comments